newport news property tax exemption

Skip to Main Content. Newport news va 23607 main office.

City Of Newport Tax Assessor S Office

At other times normal.

. Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property. Bonneville County Property Tax Rate. NEWPORT City homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the.

Application window is January 1st through March 15th. Learn all about Newport News County real estate tax. Revocation Of Separation Agreement.

2021-22 Tax Appeal Form for Real Estate and Tangible Personal Property. Note- City code requires that all. Disabled Veterans Property Tax Exemption.

The Newport News Office of the Commissioner of Revenue is accepting applications for the Seniors and Disabled Property Tax Relief Program available to Newport. California Consent To Enter Judgment For Possession. Determine what your real real estate tax bill will be with the higher value and any exemptions you are allowed.

Residents of the City of Newport age 65 and older who have lived in their homes for a. For a two-family home the maximum amount is a 20 exemption. Learn how we calculate your vehicles discount for your personal property tax.

All groups and messages. Then question if the size of the increase is worth the work it will take to appeal the. However if you do not plan to apply for Real Estate Tax Exemption you must separately apply for the Solid Waste Relief by contacting the City of Newport News Call Center at 757-933-2311.

The Newport News City Homestead Exemption can reduce the appraised valuation of a. When an automobile is licensed with out-of-state tags solely in the military members name a Newport News personal property return is not required. Regular Irregular Polygons Worksheet.

If you are in the. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local. Personal Property Tax Relief Act The tax on the first 20000 of the assessed value of your qualified personal property will be reduced for tax years 2006 and forward.

Veterans who are 100 permanently or totally disabled with proof from the US. Some dwellings may be exempt from council tax. We are not reinventing the wheel Nicholson said.

Therefore if you file for a Real Estate Tax Exemption it will not be necessary for you to take any action or file a separate application for the Solid Waste Fee Grant Relief Program. The City of Newport News Treasurers Office makes every effort to produce and publish the most current and accurate property tax information possible. Find information about tax relief deferral exemption and abatement.

The General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. Newport News VA 23607 Main Office. 757-247-2628 Department Contact Business License.

The Newport News City Council voted to switch from a tax exemption program to a deferral last year which means that instead of being exempt from property taxes lower. For qualifying vehicles valued at 1000 or less your obligation to pay this tax has been eliminated for tax years 2006 and forward. Loading Do Not Show Again Close.

Refer to Car Tax Relief qualifications. Any exemptions awarded are calculated on a daily basis for the period when the particular circumstances apply. Currently the city has a two-tier system for property tax.

The real estate tax exemption program. Cold War Veterans Now Qualify for Tax Exemption. 2022 Senior Citizen Exemption Form.

Newport news has 8 rebates and tax credits that you may be eligable for. Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from. For properties considered the primary residence of the taxpayer a homestead exemption may exist.

APPLICATION for SENIOR PROPERTY TAX EXEMPTION CLAIM. Newport news va 23607 main office.

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Youth Challenge To Seek City Tax Exemption Funding Chicago Tribune

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Newport Health Center In Property Tax Dispute Valley News

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

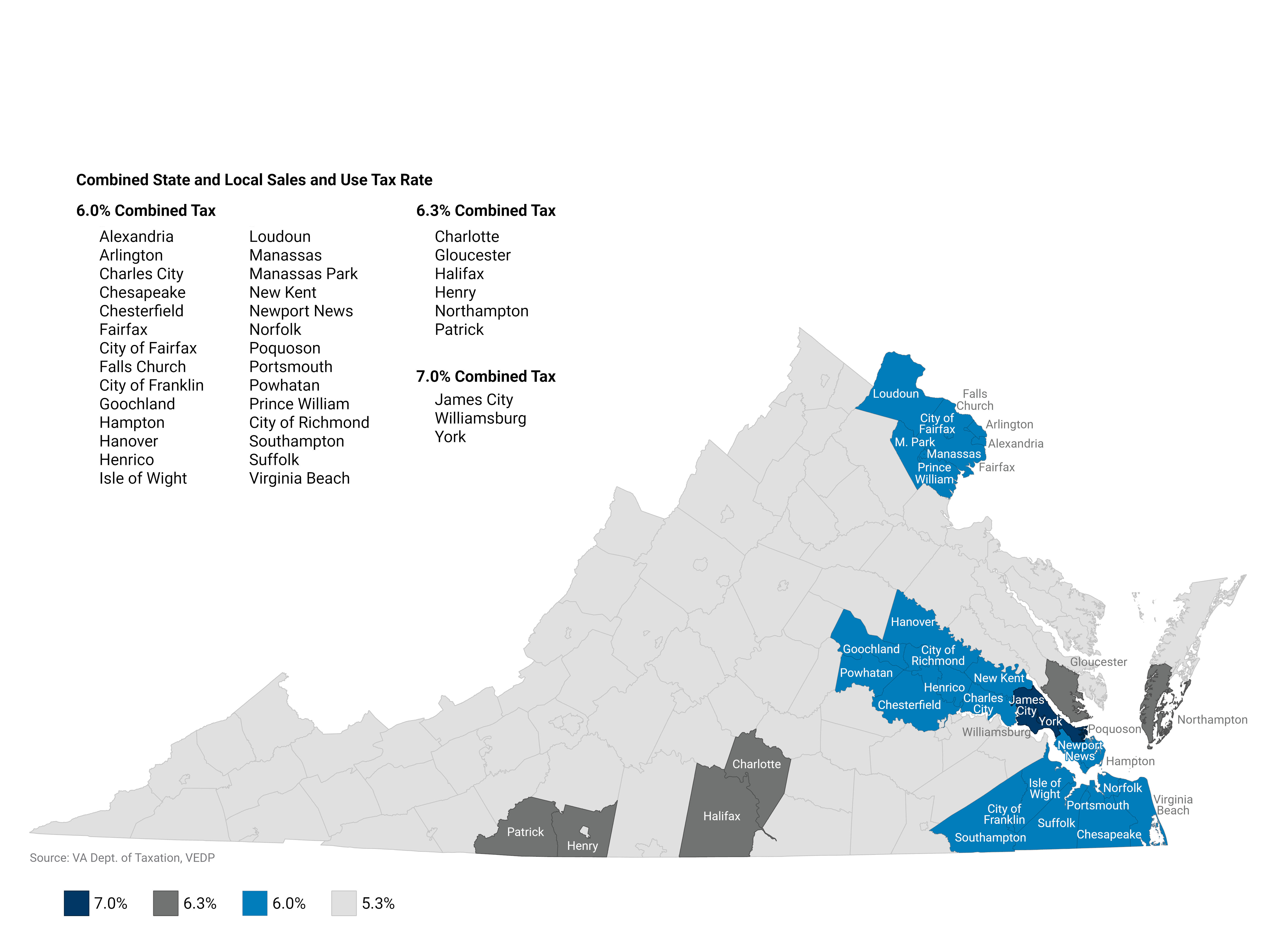

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Commissioner Of The Revenue Newport News Va Official Website

Fill Free Fillable Forms City Of Newport News

The Complete Guide To Garnishment Exemptions Law Merna Law

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com

Newport News Commissioner Of The Revenue Holds Forum To Help Veterans Understand Property Tax Change Wavy Com